Therefore, the latter examples (hair dye and customs fees) refer to the specific cost of goods sold for their businesses, while the former examples (gas and electricity) refer to overhead costs that are typical for any other business.įor this reason, many overhead expenses for businesses are common and there can be lots of ways to reduce how much they cost.

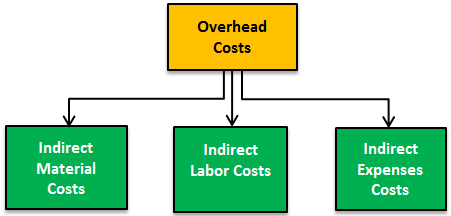

One business might pay for staff and hair dyes in this example, while the other has to pay international delivery and customs fees. However, because one retails imported products and the other is a women’s salon, their other costs of goods sold differ. What Is Considered Overhead Cost Rent Property taxes Administrative expenses Utilities Sales and marketing Repair and maintenance of motor vehicles and. Use the following prompt as a question to answer: “Is this an expense for my business or any business?”įor example, two shops side by side can each have shared overhead costs, such as electricity and gas, insurance and rent. One way to decide whether a certain expense to your business is an overhead or not is if it can be shared with a different business. Separating expenses into ‘overheads’ versus ‘cost of goods sold’ (or COGS) can be slightly tricky and will depend on your own business. How are overhead costs different from ‘cost of goods sold’? Meanwhile, paying for public liability insurance means everyone is protected if something bad happens in your shop. For example, paying for rent and utility overheads means you can have warm and well-lit dedicated business premises for customers to visit. Overhead costs can include a broad array of ordinary expenses, such as a storage facility used by the whole project or travel expenses for project managers to attend meetings. Together, these sources of expenditure help your business in different ways, even if they cost you money. Marketing and advertising (including website hosting and any social media adverts).Travel (car loans, fuel, road tax, etc.).Council permits or licenses for your premises.Insurance ( public liability or business car insurance) Maintenance (for both office equipment and production-related machinery).Rent and utilities (like gas, electricity, etc.).Overhead costs typically refer to the following: Specifically, overhead costs are areas you spend money on to run your business but aren’t directly related to your product or service. A business ‘overhead’ is a category of business expense that is used to separate certain costs from others and are also known as ‘ operating expenses’.

0 kommentar(er)

0 kommentar(er)